HMRC will determine an individual's tax-free Personal Allowance using their most recent records. Untaxed income, unpaid tax from a prior year, and the value of any job-related perks (e.g. a company car). The untaxed income is reduced from the Personal Allowance to determine the new tax-free income permitted in the tax year. This tax-free allowance is multiplied by ten to reflect it in the year's tax code. The impact of a second job on your tax code

The new tax year began on 6 April, and millions of full- and part-time employees in the United Kingdom, as well as those with a private employer pension, have been granted a tax code.

This brief arrangement of numbers and letters may seem innocent, but if done incorrectly, you might wind yourself paying hundreds or thousands of pounds more in tax to HM Revenue & Customs than necessary.

Foreign entities that are not individuals (i.e., foreign corporations, etc.) and that are required to have a federal Employer Identification Number (EIN) in order to claim a tax treaty exemption from withholding (as claimed on Form W-8BEN) must submit to the Internal Revenue Service Form SS-4 Application for Employer Identification Number. Foreign entities submitting Form SS-4 in order to get an EIN in order to claim a tax treaty exemption and which are not otherwise required to file a US income tax return, employment tax return, or excise tax return should follow the particular guidelines below when completing Form SS-4. Unless the applicant already possesses an SSN or ITIN, the applicant should enter "N/A" in the section requesting an SSN or ITIN on Line 7b of Form SS-4. When responding to question 10 on Form SS-4, the applicant should tick the "other" box and shortly thereafter write or enter one of the following phrases: "Intended for W-8BEN Use Only"

Employers enroll in Pay As You Earn in order to deduct National Insurance and income tax from workers on a per-payroll basis. When you register for the PAYE program, you are assigned a PAYE reference number. Employers provide this number to their workers so they may identify their employer if they speak with HMRC. Employers also make reference to it while dealing with HMRC.

How To Check Tax Code In Sap

This is the most often seen sort of tax code. It is often applicable to domestic purchases (or sales) made from a VAT-registered business. The tax rate varies by nation and product category. It is indicated in the tax condition as VST for purchases and MWS for sales. Utilization of a standard account key VST in a tax code

What the T-code letters indicate:

Module F FINANCIAL FB SHARED FINANCIAL TRANSACTIONS t-code (SHARED BETWEEN AP AR ASSETS GL) FS LEDGER ACCOUNTS FOR FK FINANCIAL VENDOR MASTER M MANAGEMENT OF MATERIALS MB RECEIPT OF GOODS â INVENTORY MANAGEMENT ME PURCHASING REQUIREMENTS ME1 PURCHASE REQUIREMENTS ME2 ORDER OF PURCHASE MATERIAL MASTER MATERIAL MATERIAL MATERIAL MATERIAL MATERIAL MATERIAL MATERIAL MATERIAL MATERIAL MATERIAL MATERIAL MATERIAL MATERIAL MATERIAL MATERIAL MATERIAL MATERIAL MATERIAL MATERIAL MATERIAL V COMMERCIALIZATION AND DISTRIBUTION ORDERS FOR VA SALES VF BILLING XD MASTER CENTRAL CUSTOMER XK MASTER CENTRAL VENDOR

After generating the Taxcode, we must associate it with the Company code in the database J 1ICONDTAX.

Please go to SPRO > Logistics general > Tax on products mvmt > India > Excise duty determination > Assign a tax code to the business code. In Development, you may establish a Tax code and associate it with a Company code. No transport request will be made during the FTXP creation process. Return to FTXP and enter the tax code, then choose the Export option from the menu. It will ask you to submit a request for transport. The only exception is that Condition records are considered Master data and hence cannot be transported. Required condition types need manual creation of condition data in FV11. The processes for configuring a tax code are as follows: 1. Maintain the tax procedure OBQ1. 2. Maintain the Accounting OBCN's tax processing. 3.Change the procedure's view and go to the control OBQ3 4. Continue to use the Tax Code FTXP 5. Modifying the General Ledger Master to apply TAX Code FS00 6. Assign the General Ledger to Maintain Configuration for automatic posting of OB40. 7. Include the Tax Code in your posting. https://scn.sap.com/thread/3143808 http://help.sap.com/erp2005 ehp 04/helpdata/en/9e/0b941b0fd64873bc54e8745fb044e7/content.htm http://help.sap.com/saphelp rc10/helpdata/en/0e/db7eb4e9114d85a9335fb1df617504/content.htm http://wiki.openbravo.com/wiki/ERP 2.50:Configuration Manual/Setting up taxes#Tax Concepts7 http://www.itstuffs.net/2013/01/tax-settings-salespurchase-configuration.html http://www.sapficoconsultant.com/pdf/GL%20config%20free%20e-book.pdf http://www.saptechies.org/taxonsales-purchases/

The Tax Category classifies and manages related product or service tax rates. Each tax law has its own set of tax rates. Tax rates are associated with Tax Types and are included into tax processes (in this relationship, it is technically possible that a single tax code can have multiple tax rates for various tax types.) The tax code is associated with a Tax Procedure, which is associated with a General Ledger master record. When a certain general ledger account is utilized for document processing, a specific tax procedure is accessible. Step-1.1

How To Check Tax Code Online

If your salary exceeds £100,000, you will not get the basic personal allowance. It is reduced by £1 for every £2 earned in excess of this amount. If you make more than £122,000, you lose your whole allowance and all of your income is taxed. Savings income: As a basic-rate taxpayer, if you earn more than £1,000 in interest, your tax code will be modified. However, if your interest is smaller than this, your code should remain unchanged.

Notification of legal nature

The information published on this page and all other pages dedicated to TIN (hereinafter referred to as the "European TIN Portal"), as well as the use of the TIN online check module provided on this European TIN Portal, of which it is a component, are subject to a disclaimer, a copyright notice, and rules governing the protection of personal data and privacy, which are available on the legal notice page.

The IRS strongly encourages taxpayers to file online and to initiate direct deposit requests as soon as they receive the necessary information. This will assist in expediting their returns. If your refund has been accepted, you should see an expected date of deposit into your bank account. Additionally, there should be a separate deadline for contacting your bank if you have not received your refund by that time.

txcd 40090008 Nutritional supplements Products in different forms meant for consumption and labeled as a normal food but identified as a nutritional supplement by the "Nutrition Facts" section on the label. txcd 40100001 Sweets and candies A confectionery made with natural or artificial sweeteners, chocolate, fruits, nuts, or other ingredients or flavorings and available in the shape of bars, drops, or bits.

How To Check Tax Code Nz

The tax codes maintained by HMRC govern the amount of tax you pay on your wage. This tax is referred to as PAYE (Pay As You Earn), and the various brackets, which are determined by particular factors such as your income and age, are denoted by a code letter. The approach simplifies the process of paying PAYE tax by deducting it prior to an employee receiving it, with the employer immediately paying HMRC the combined amount of a firm's staff taxes. This eliminates the need for individuals, unlike self-employed persons, to calculate their tax liability and pay it themselves.

When deductions for employer-provided benefits, state pension, or unpaid tax from past years exceed your Personal Allowance. The L Code indicates that you are eligible for the standard tax-free Personal Allowance. You are entitled to the standard tax-free Personal Allowance. The M Code indicates that your spouse has transferred you up to 10% of their Personal Allowance.

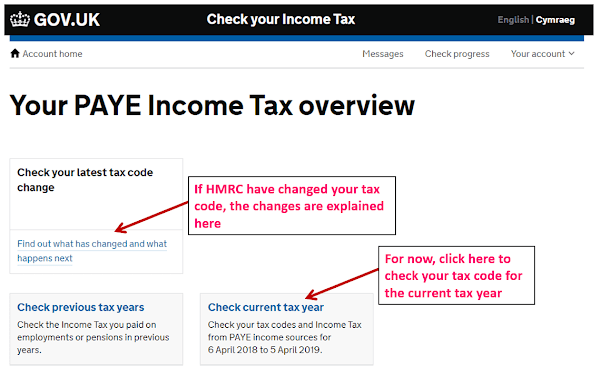

Discover your tax code. To determine your current year's tax code, use the check your income tax online feature inside your Personal Tax Account. Additionally, you may check your tax code for the following reasons: a prior tax... Summary Of Your Search For Check Tax Codeâ Average Savings Rate: 49% Coupons: 6 Deals: 7 Best Coupon: 69% This page was last updated on March 14, 2022.

If you want assistance in obtaining evidence of your Income Tax number, please click on the picture below to see our helpful training video on the SARS YouTube channel.

If you want assistance with utilizing the SMS service, please click on the picture below to see our helpful training video on the SARS YouTube channel.